China's King of Medicine vs. World's King of Medicine "Sales TOP List"

Release time:

2024-05-25 10:19

Source:

What surprises will it bring when the Chinese Medicine King competes with the World Medicine King?

01

Sales TOP list

The world's leading drug in 2023 is Merck's oncology antibody therapy Keytruda, with annual sales reaching US$25 billion, a year-on-year increase of nearly 20%.

Keytruda's growth rate of nearly 20% is definitely a remarkable achievement for a drug of such a large scale, far exceeding the second-place Humira ($14.4 billion) in the sales ranking.

Table 1 Top 20 global pharmaceutical sales in 2023

Data source: compiled based on annual reports of various companies (unit: US$ 100 million)

Note: The data are all manually sorted by the author. If there are any omissions, please leave a message to correct them.

If nothing unexpected happens, Keytruda's title as the king of medicine will be safe in the next few years. The real threat to Keytruda's status is not the declining Humira, which has passed its peak sales, but the thriving type 2 diabetes drug Ozempic, which analysts expect to have sales of more than $20 billion in 2025. By then, Keytruda will also be at the end of its golden career. Analysts predict that Keytruda's peak sales will arrive in 2027, a year before the patent expires, when its sales are expected to reach an awe-inspiring $31.3 billion.

Keytruda and Humira, the new and old kings of drugs, have one significant thing in common, that is, they both belong to the PIP (pipeline-in-a-pill) type, that is, drugs with their own pipelines. Its characteristic is that it corresponds to a huge number of approved indications, and one drug is a pipeline. Keytruda received approval for eight FDA indications in 2023, including adjuvant treatment after surgical resection and platinum-based chemotherapy in patients with non-small cell lung cancer, advanced microsatellite highly unstable or mismatch repair-deficient solid tumors, etc. Since its first approval for advanced melanoma on September 4, 2014, Keytruda has received 47 FDA approvals for different indications (including regular approval after accelerated approval). Turning our attention back to China, among the local innovative drugs launched in China from 2018 to 2023, BeiGene’s zanubrutinib ranked first in sales last year, with annual sales of US$1.26 billion (Table 2).

Table 2 Top 25 Chinese New Drug Sales in 2023

Data source: compiled from the annual reports of various companies (unit: US$100 million, 1 US dollar = 7.24 RMB)

Note: Statistics include domestically produced innovative drugs approved from 2018 to 2023, excluding vaccines, traditional Chinese medicines and blood products; Sepalizumab only has sales data from January to May, and the annual sales are magnified proportionally; the data are all manually sorted by the author. If there are omissions, please leave a message to correct them.

Like the global drug king Keytruda, Zanubrutinib is also an oncology product. As a new type of potent BTK inhibitor developed locally, Zanubrutinib can form complete and lasting precise inhibition of the BTK target after molecular structure optimization. It was approved by the FDA on November 9, 2019, and previously received the titles of breakthrough therapy and priority review, achieving a historic breakthrough in the overseas expansion of Chinese oncology assets.

Like Keytruda for multiple indications, Zanubrutinib has also been approved in China for multiple indications, including mantle cell lymphoma, chronic lymphocytic leukemia/small lymphocytic lymphoma, and Waldenstrom's macroglobulinemia, which have received at least one previous treatment. FDA-approved indications also include mantle cell lymphoma, Waldenstrom's macroglobulinemia, marginal zone lymphoma, chronic lymphocytic leukemia, and follicular lymphoma.

Unlike Keytruda, Zebutinib is a small molecule drug with certain cost advantages.

02

Indications and drug modality comparison

1.1 Number of drugs

From the perspective of indications, there are huge differences in "high-sales products" between the Chinese and global sectors.

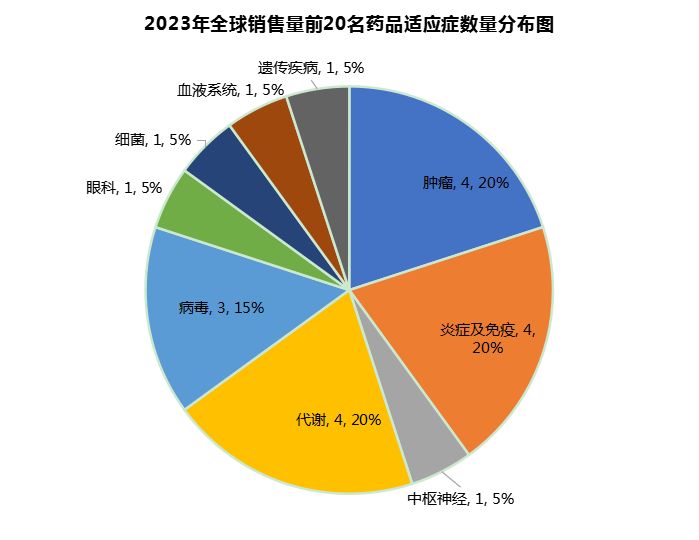

The top 20 products in terms of global sales in 2023 correspond to nine categories, including tumors, inflammation and immunity, central nervous system, metabolism, viruses, ophthalmology, bacteria, blood system and genetic diseases. Among them, the number of products in oncology, inflammation and immunology and metabolic diseases is the largest, with 4 each. There are 3 viral drugs (including vaccines), and each of the remaining fields has one super-giant product (Figure 1).

This reflects the broader indication focus of the international market and the corresponding market return. Although tumors, immune and metabolic diseases provide lucrative profits, there is still a huge market development space that can breed super blockbuster drugs such as Eylea in ophthalmology, and can also provide a market of more than US$7 billion for central nervous system therapies for multiple sclerosis such as Ocrevus.

This fully demonstrates the strong incentive of the international market for the development of new therapies, especially those with huge unmet needs.

Figure 1 Distribution of the top 20 indications for global drug sales in 2023

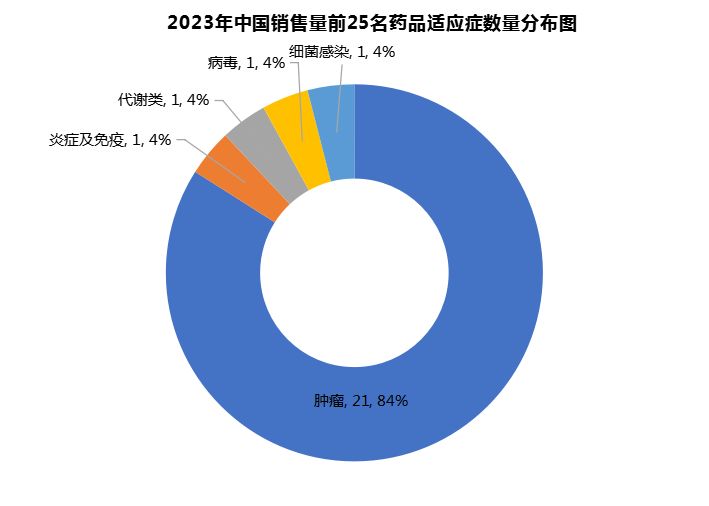

Looking at the top 25 new drug sales in China in 2023, oncology products account for almost 85% in terms of quantity. 21 of the 25 products target cancer. There is one product each for inflammation and immunity, metabolism, viruses and bacteria. The number of indications is more concentrated than that of the international market, and almost all of them are oncology products.

This shows that the focus of domestic new drug development is still on cancer, while metabolic and immune diseases, which have great development potential, have not yet been covered by blockbuster new drugs. Although there are huge patient groups in these fields, the corresponding therapies may still be traditional old drugs, and the new drugs in the pipeline have not yet hit the finish line or the market returns have not yet appeared.

As domestically produced GLP-1 and related products gradually enter the market, I believe this situation is expected to change in the short and medium term, and the new drug market will enter a state of "all kinds of things competing freely in the frosty sky."

Figure 2 Distribution of the number of indications for the top 25 Chinese innovative drugs in 2023

1.2 Sales by Indication

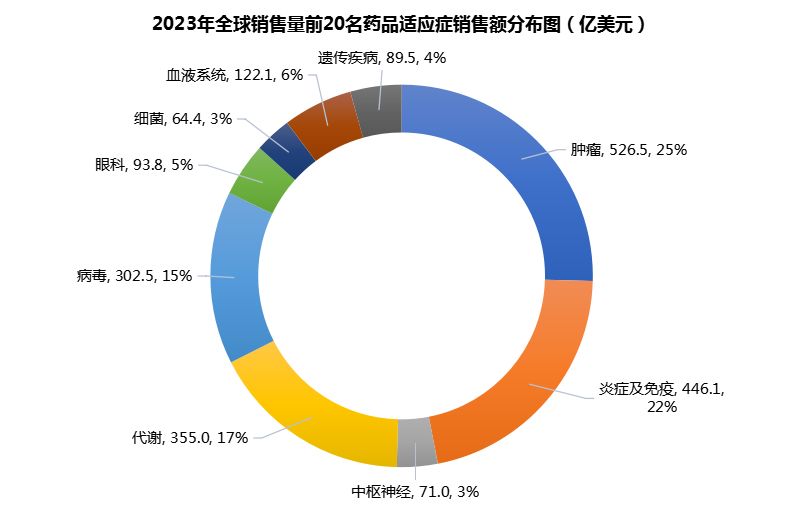

From the perspective of sales corresponding to different indications, tumors are still the indication with the highest sales volume in the international market (Figure 3). Among the top 20 products, oncology assets will have a total sales of US$52.65 billion in 2023, accounting for 25%. Next is inflammation and immunology products , which will achieve annual sales of US$44.61 billion (22%). Ranked third is metabolic disease therapy , which will achieve total sales of US$35.5 billion in 2023 (17%).

Looking ahead, this three-legged situation will last for a long time, but the specific distribution may be slightly adjusted. Keytruda's peak sales will arrive in 2027, and then it will enter a decline period as the patent expires.

In terms of immunology products , Humira and Stelara are expected to drop out of the top ten in the next two years, and will be replaced by AbbVie's emerging immunology product Skyrizi. According to AbbVie's latest Q1 2024 financial report, Skyrizi is expected to achieve sales of 10.6 billion this year and 13.2 billion US dollars in 2025.

The metabolic disease field has greater potential . Eli Lilly's diabetes drug Jardiance benefits from the expansion of indications and is expected to rank among the top ten this year and achieve sales of more than $10 billion. Ozempic sales are expected to exceed $20 billion in 2025, while Novo's weight loss drug Wegovy is expected to rank among the top ten next year, reaching annual sales of $12.8 billion.

Figure 3 Distribution of global top 20 drug sales by indication in 2023

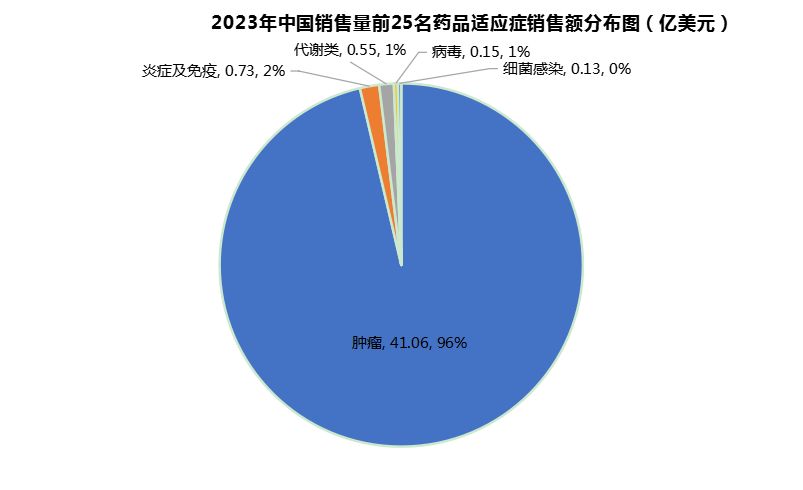

Among the TOP25 indications of new drug sales in China in 2023, cancer ranks first in sales, accounting for 96% of sales, far higher than the second-ranked inflammation and immune diseases (2%) (Figure 4). Compared with the number, the "bias" of indications is more serious. This reflects the profit tendency of too single new drugs, and also shows the shortcomings of new drug development and commercialization in other indications, especially in indications with huge potential markets such as metabolic diseases and immune diseases. There is a huge difference between the sales performance of new drugs and the international sector, and domestic pharmaceutical companies need to catch up and cultivate these markets with strong return capabilities.

Figure 4 Sales distribution of top 25 indications of domestic new drugs in 2023

2. Drug modality

2.1 Number of drug modalities

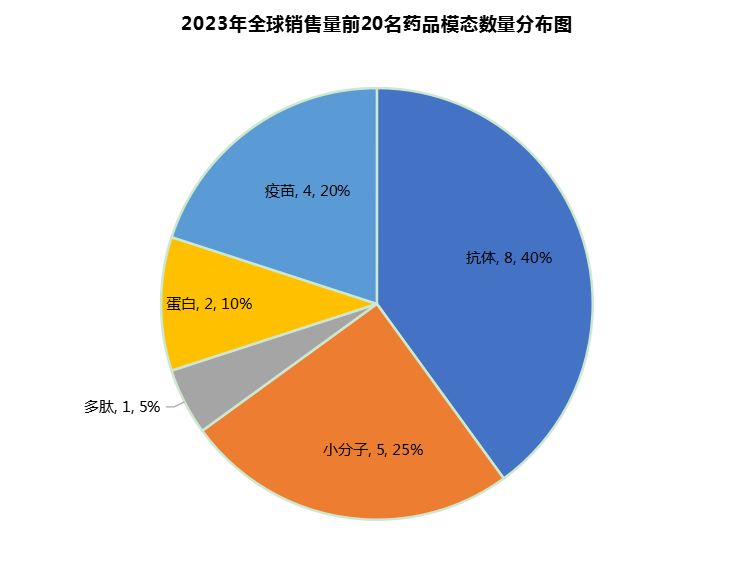

From the perspective of drug modality, antibody products account for the largest number of the top 20 products in the global sector, reaching 8 (40%), followed by small molecules (5, 25%), vaccines (4, 20%), proteins (2, 10%) and peptides (1, 5%) (Figure 5).

Figure 5 Distribution of the number of modalities of the top 20 drugs worldwide

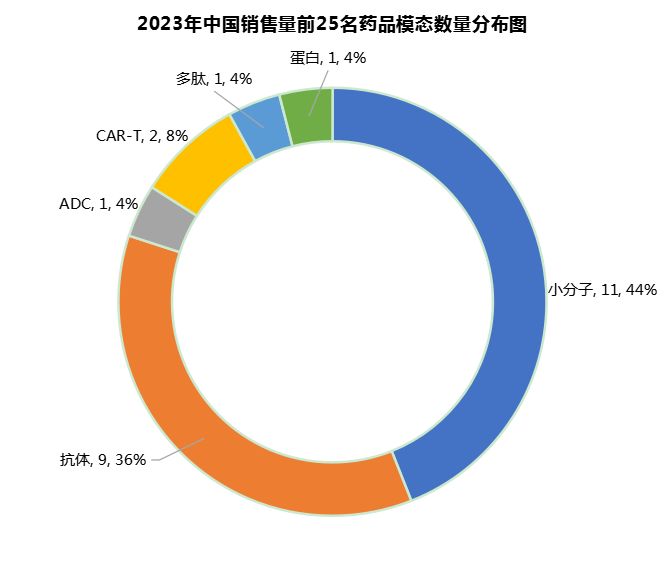

Among the top 25 new drug sales in China in 2023, small molecule drugs ranked first (11, 44%), followed by antibodies (9, 36%) (Figure 6).

It is worth noting that CAR-T products have been listed among domestic new drugs. Among the top 25 therapies in terms of sales in 2023, there are two CAR-T products, namely Legend Biotech's Carvykti (US$500 million) and Innovent Biologics' relma-cel (US$24 million). In addition, there is also an ADC and a peptide drug.

Figure 6 Distribution of the number of top 25 domestic new drugs

2.2 Drug sales by modality

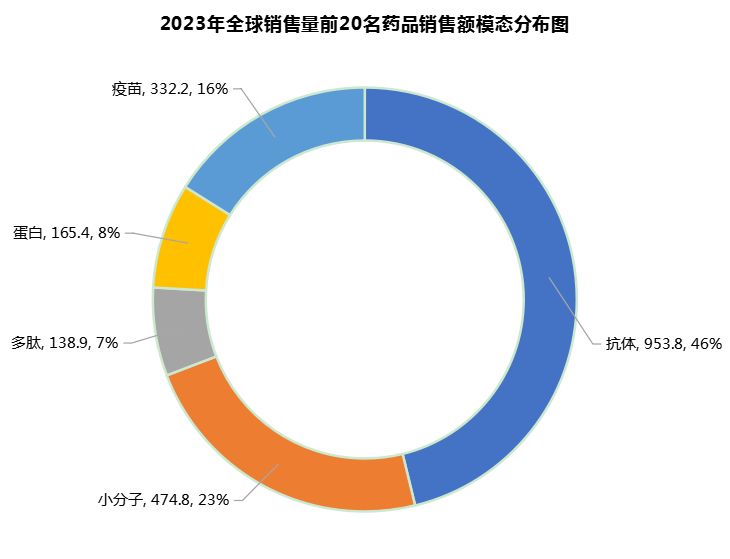

In terms of sales volume corresponding to the modality, antibody drugs in the global market generated sales of US$95.4 billion in 2023, accounting for nearly half (46%) of the top 20 drugs, followed by traditional small molecule drugs (US$47.48 billion, 23%), vaccines (US$33.22 billion, 16%), proteins (US$16.5 billion, 8%) and peptides (US$13.9 billion, 7%) (Figure 7).

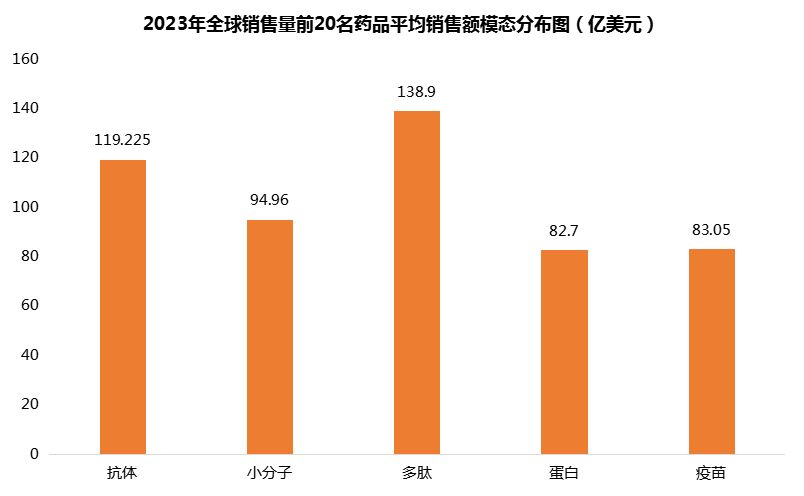

However, from the perspective of average sales, peptide drugs performed best, which was determined by the strong sales performance of Ozempic, followed by antibodies and small molecules (Figure 8).

From a statistical analysis perspective, although the average sales of antibodies were greater than that of small molecule drugs, there was no statistically significant difference between the two groups. Its P value is 0.3541, which is much higher than the 5% significance level (Table 3).

Figure 7 Corresponding graph of total sales volume of the world's top 20 drugs by modality

Figure 8 Average sales volume of the top 20 drugs in the world

Table 3 t-test analysis results of the top 20 global drug products in 2023, antibodies and small molecule drugs

Data source: Calculated based on the drug sales data in the annual reports of various companies

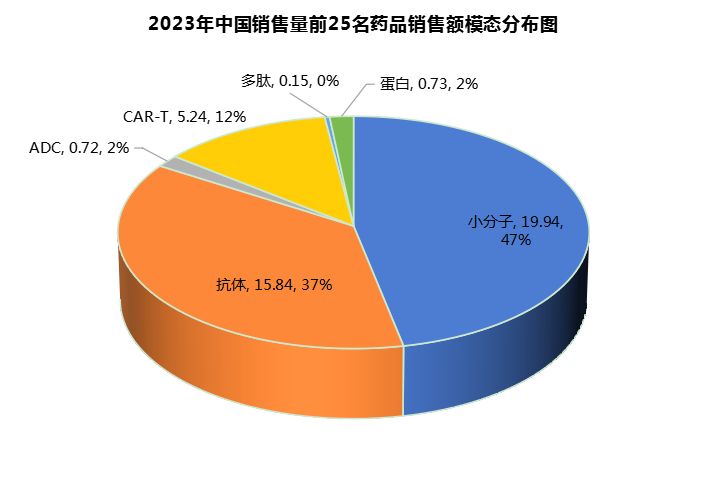

Among the top 25 new drug sales in China in 2023, small molecule drugs (US$1.994 billion, 47%) have the highest total sales, accounting for almost half of the total sales, followed by antibodies (US$1.584 billion, 37%) (Figure 9).

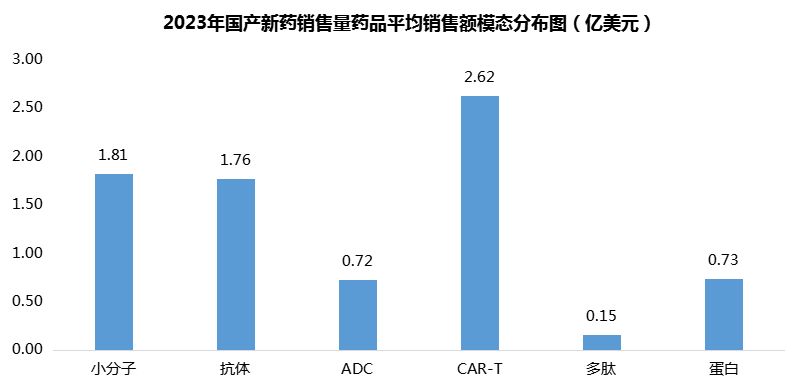

On average, each CAR-T product generated $262 million in sales, with small molecules ranking second ($181 million) and antibodies third ($176 million) (Figure 10).

Figure 9 Corresponding graph of total sales volume of top 25 domestic new drugs

Figure 10. Average sales volume of domestically produced drugs by modality

03

FDA approval impact

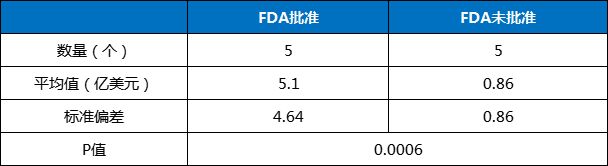

Among the top 25 new drug sales in China in 2023, 5 have been approved by the FDA, and some of the remaining 20 are undergoing clinical trials for FDA regulatory decisions.

The five FDA-approved drugs achieved a total sales of US$2.549 billion, with an average of US$510 million each, covering small molecules (2 drugs), antibodies (2 drugs) and CAR-T (1 drug).

The 20 drugs that have not been approved by the FDA have received a total of US$1.713 billion, with an average of US$86 million each. The t-test analysis showed (Table 4) that there was a statistically significant difference between the two groups of data.

Domestic new drugs approved by the FDA have a significant advantage in sales compared with unapproved new drugs.

Table 4 t-test analysis results of domestic new drugs approved by FDA in 2023

Data source: Calculated based on the drug sales data in the annual reports of various companies

04

Conclusion

At present, although the sales of domestic new drugs cannot be compared with the tens of billions of dollars of drugs in the US market, comparing the performance of the two sectors can still give people some inspiration, especially what are the unmet areas in the market, which can serve as a guide for future development.