Eli Lilly buys an injection factory! GLP-1 production capacity "ceiling", putting pressure on Novo Nordisk?

Release time:

2024-04-27 09:32

Source:

The battle for GLP-1 production capacity between Eli Lilly and Nordinovo, the two "weight loss drug giants", is becoming increasingly intense.

Recently, Eli Lilly announced a final agreement with sterile drug manufacturer Nexus Pharmaceuticals to acquire the latter's injectable drug manufacturing plant in Pleasant Prairie, Wisconsin, USA. Eli Lilly believes that this acquisition will further expand its global manufacturing network for injectable products and support the market's increased demand for the company's related drugs. Eli Lilly estimates that the plant may begin production by the end of 2025.

Eli Lilly's investment in new production capacity comes at a time when market demand for its GLP-1R/GIPR dual agonist telportin is surging, which has also attracted much attention from the industry. However, a spokesperson for Eli Lilly declined to comment on whether the company's popular drugs for the treatment of obesity and diabetes will be produced at the plant. It is worth mentioning that the new plant does not provide contract manufacturing services, and only allows the plant to be responsible for Eli Lilly's manufacturing tasks.

In the industry's view, the competition between Eli Lilly and Novo Nordisk in the blood sugar reduction and weight loss market has evolved into a capacity war. The two pharmaceutical giants have been working hard to build their own manufacturing networks to maintain their "relative advantages" with their competitors. In February of this year, Novo Holdings, the parent company of Novo Nordisk, directly spent a huge amount of US$16.5 billion to acquire CDMO giant Catalent, temporarily leading the capacity race. But now, Eli Lilly, unwilling to lag behind, is also trying every means to catch up with its old rival at full speed.

Eli Lilly may be in a dilemma of "no factory to buy" after investing $11 billion to increase production capacity?

According to the financial report, the sales of Mounjaro, the glucose-lowering version of telpotide, reached $5.163 billion in 2023, a year-on-year increase of 970%; and Zepbound, the weight-loss version of telpotide, which was approved for marketing in the United States in November 2023, generated $176 million in revenue in less than two months. The unexpected market sales also allowed Eli Lilly to increase its revenue forecast for telpotide in 2024: Mounjaro sales of $7.491 billion and Zepbound sales of $2.362 billion.

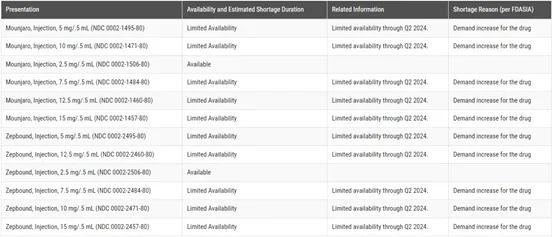

Due to the large market demand, Eli Lilly expects that the supply of specific doses of telpotide will still face occasional interruptions in the short term in the future, thus affecting some of the volume releases. At present, Mounjaro and Zepbound still appear in the drug shortage database on the official website of the U.S. FDA. Due to increased demand, multiple specifications of the drug will be in limited supply before the second quarter of 2024, which confirms Eli Lilly's judgment.

However, in the earnings call, Eli Lilly's Chief Financial Officer Anat Ashkenazi said: "We are seeking a range of internal and external projects, both large and small, to further expand production capacity." The acquisition of Nexus Pharmaceuticals' Pleasant Prairie plant is obviously an important part of Eli Lilly's projects.

It is reported that the plant started construction in 2019 and opened in 2021, with an investment of approximately US$100 million. The facility covers an area of more than 84,000 square feet and has manufacturing space, packaging capabilities, warehousing, and analytical, environmental and microbiological testing. Designed to manufacture a wide range of injectable drugs, the plant is equipped with advanced isolator technology and meets the current highest good manufacturing practice (CGMP) standards. It has been verified by the US FDA's regulatory approval process in May 2023.

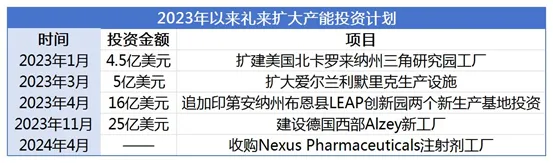

In fact, the new injection plant acquired this time is just the latest attempt in a series of recent initiatives by Eli Lilly. In the past few years, Eli Lilly has allocated approximately US$11 billion to expand its manufacturing capabilities to cope with the production capacity competition of weight loss drugs.

In May 2022, Eli Lilly announced an investment of $2.1 billion to build two new production bases at the LEAP Innovation Park in Boone County, Indiana. The new production base will strengthen Eli Lilly's manufacturing network for APIs and new therapies. In April 2023, Eli Lilly announced an additional investment of $1.6 billion to add 200 new jobs to the two new production bases in the Innovation Park, bringing the total committed investment to $3.7 billion.

In addition, Eli Lilly has invested $4 billion in two factories in North Carolina, USA, and has doubled the production of GLP-1 drugs by the end of 2023. In January 2023, Eli Lilly announced an investment of $450 million to expand its factory in the Research Triangle Park in North Carolina, USA, to provide additional drug filling, equipment assembly and packaging capabilities for products including GLP-1 drugs. In March 2023, Eli Lilly announced

that it would invest another $500 million in its production facility in Limerick, Ireland, bringing the total investment in the facility to approximately $1 billion. In January 2022, Eli Lilly announced an investment of US$446 million in the plant to expand the production of active pharmaceutical ingredients and monoclonal antibodies.

In April this year, Eli Lilly held a groundbreaking ceremony for a new factory in Alzey, western Germany. Eli Lilly revealed that the factory is mainly used to produce injectable drugs and injection pens. It is expected to start construction this summer and officially put into operation in 2027. The products produced will be sold to countries around the world and will become its sixth production base in Europe. It is reported that Eli Lilly plans to invest $2.5 billion in the factory, which is also the largest investment in the pharmaceutical industry since the reunification of Germany. It aims to help Eli Lilly solve the shortage of drugs including GLP-1 drugs.

Although Eli Lilly is carrying out its most significant expansion plan in history, it will still take some time to increase the production capacity of GLP-1 drugs, which has prompted Eli Lilly to learn from its competitor Norden and directly acquire injection factories with complete facilities to quickly fill the production capacity gap.

However, while the acquisition of existing facilities may accelerate Eli Lilly's pace of capacity expansion, Eli Lilly CEO Dave Ricks admits that this approach faces certain challenges. "The reality is that there is not much available built capacity at all, because most of it has been deployed to produce leading products in the GLP-1 field, at least at any scale, and the delivery cycle of new capacity is three to four years."

This means that Eli Lilly, which is boldly investing in GLP-1 drug production capacity, may be in an embarrassing situation of "no factory to buy".

How to seize the GLP-1 drug market faster? How to continue to maintain a super high market value? These will become the problems that

Eli Lilly must face next. Novo Nordisk frequently makes big moves and puts the expansion of production in the Chinese market on the agenda

. The successful commercialization of Zepbound has enabled Eli Lilly and Novo Nordisk, old rivals in the diabetes market, to engage in a new head-on confrontation in the weight loss drug market. In fact, Novo Nordisk, which holds the first-mover advantage of semaglutide, started to expand its production capacity as early as 2017. Data shows that from 2022 to 2023, Novo Nordisk will invest a total of more than US$5 billion in all related production plants to respond to growing market demand by intensively expanding production capacity.

In June 2023, Novo Nordisk announced plans to invest DKK 15.9 billion (approximately USD 2.3 billion) to expand its existing API production facilities in Denmark. This investment will create 340 new jobs and will also play a key role in Novo Nordisk's future development of its late-stage clinical product portfolio. In

November 2023, Novo Nordisk announced plans to invest more than DKK 42 billion (approximately USD 6 billion) in the next few years to expand its existing production facilities in Kalundborg, Denmark, for the production of current and future severe chronic disease product portfolios. This investment will create additional capacity across the entire global value chain from API manufacturing to packaging, with the vast majority invested in API capacity. It is reported that the construction project will be completed gradually between the end of 2025 and 2029, and is expected to create 800 new jobs.

In the same month, Novo Nordisk announced plans to invest more than 16 billion Danish kroner (approximately US$2.3 billion) starting from 2023 to expand its existing production plant in Chartres, France, to provide current and future products in the field of serious chronic diseases. Group layout. The investment will significantly increase the manufacturing site's capacity, increase sterile manufacturing and finished product production processes, and expand the existing quality control laboratory. Novo Nordisk said that this investment includes GLP-1 product production capacity and will enhance its ability to meet future demand for innovative products. This construction plan will be gradually completed from 2026 to 2028.

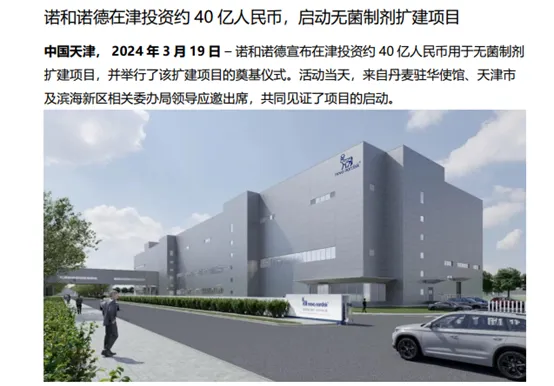

Unlike Eli Lilly, which focuses on expanding production capacity in European and American countries, Novo Nordisk has also set its sights on the Chinese market. In March this year, Novo Nordisk China announced that it would invest approximately 4 billion yuan in a sterile preparation expansion project in Tianjin and held a groundbreaking ceremony for the expansion project. The plan is expected to be completed in 2027. This is not the first expansion of Novo Nordisk's Tianjin production plant. As early as early 2023, Novo Nordisk invested 1.18 billion yuan in the factory to expand its finished product workshop and introduce a prefilled injection pen production line. From the perspective of the industry, this prepares the company for the launch of its weight loss drugs in the Chinese market.

It is worth mentioning that in addition to intensively expanding production capacity, Novo Nordisk is also taking more diversified ways to increase production capacity deployment, and deepening cooperation with CDMO is one of its important ways. In August 2023, in order to meet the growing market demand for Wegovy, a weight-loss version of semaglutide, Novo Nordisk reached a production cooperation with production contractor Thermo Fisher. It is reported that Thermo Fisher provides Novo Nordisk with semaglutide filling injection pen production services through its CDMO subsidiary Patheon at a factory in Greenville, North Carolina.

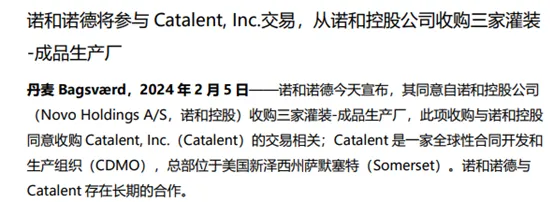

In February of this year, Novo Nordisk even made a big move and directly took the production capacity of CDMO giant Catalent. On the premise that Novo Holdings, the parent company of Novo Nordisk, spent a huge amount of US$16.5 billion to acquire Catalent, as part of the transaction, Novo Nordisk will use US$11 billion to acquire three filling-finished product production plants under Catalent. The three production plants specialize in aseptic filling of drugs and are located in Anagni (Italy), Brussels (Belgium) and Bloomington (Indiana, USA). The acquisition is expected to gradually increase Novo Nordisk's filling capacity from 2026.

Industry insiders pointed out that in response to patient demand, the sales of the two GLP-1 drugs, semaglutide and tilpotide, have far exceeded market expectations, which has made it difficult for the two pharmaceutical giants, Novo Nordisk and Eli Lilly, to handle such a large-scale capacity release in a short period of time. However, the capacity problem of GLP-1 drugs is not difficult to solve. The "GLP-1 duo" has already spent a lot of money to expand its capacity, but it still needs a construction period to achieve it, which will leave a valuable window period for latecomers to enter the market.